2023 | ANNUAL REPORT

Message From The CEO

A business professor of mine used to say, “We can teach you how to be great business leaders so you can control your success and your company’s success. But the one thing we can’t teach you is how to control the weather.” If only there was such a course (Controlling Weather 101), running a property insurance company would be a breeze.

Despite not being able to control the weather, at Tower Hill we have been busier than ever improving on the things we can control. We push ourselves to be better each day so that we can deliver an exceptional experience, especially when weather does adversely impact you. Speaking of weather, 2023 was a kinder year from a hurricane landfall perspective with only Hurricane Idalia making landfall in our great state. Nonetheless it was still an active hurricane year. While we didn’t have multiple hurricanes make landfall, we did have one of the worst severe convective storm years (Property Claim Services events). These storms were extremely costly for our company, as well as other insurers in the state.

Having the proper coverage with the right company to protect your assets is so important. Many customers simply worry about the hurricanes, but the more frequent severe convective storms can be just as damaging if not more so. In the following pages, we provide more information regarding the 2023 storm season.

The lack of major hurricanes in 2023, coupled with some of the recent legislative changes, is helping to improve the outlook of the Florida insurance industry. After many

years of record losses along with an exodus of multiple Florida property insurers, the Florida insurance industry seems to be getting back to better health. This is very

important for all of us who call Florida home. We need a healthy, competitive insurance market where customers have choices. At Tower Hill, we believe that competition is good because it makes us all that much better.

You have already made a great decision to be a member of Tower Hill Insurance Exchange. We are one of the largest and most well-capitalized insurance companies in the state of Florida. Exchange is also part of Tower Hill Insurance Group, which is entering into its 52nd year of operation. We were founded in Florida and proudly serve Floridians.

It is our honor to be your insurer of choice. My team and I are here to serve you and to make sure you receive that exceptional member experience you deserve. These are not empty words; they are part of our operating principles. If you ever find yourself passing through Gainesville, Florida, where we are headquartered, please do stop by to meet some of our team members. We would love to meet you in person.

With many thanks and much appreciation, have a Happy and Healthy 2024!

Hurricane Season: 2023 Wrap Up

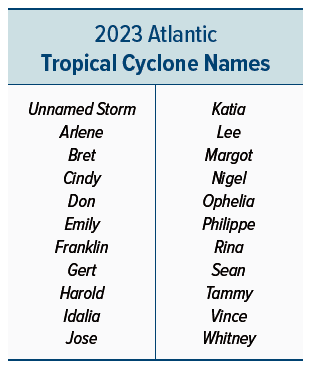

Did you know…? In 2023, we had 20 named storms in the Atlantic Basin, and that’s the fourth highest number on record. Of the 20 named storms, seven were hurricanes, and three of the storms even made it to the majors — a Category 3 storm or higher.

The season’s strongest and longest-lasting storm was Hurricane Lee in early September, which at its peak was a Category 5 with winds of 165 mph. Bermuda, the Northeastern U.S. and Canada were affected by this intense storm. The week before Hurricane Lee, a Category 4 storm – Hurricane Idalia – made landfall in the Big Bend Coastal Region of Florida and caused considerable damage.

The season’s strongest and longest-lasting storm was Hurricane Lee in early September, which at its peak was a Category 5 with winds of 165 mph. Bermuda, the Northeastern U.S. and Canada were affected by this intense storm. The week before Hurricane Lee, a Category 4 storm – Hurricane Idalia – made landfall in the Big Bend Coastal Region of Florida and caused considerable damage.

As if Hurricanes Idalia and Lee were not enough during the 2023 season, we had 70+ designated Property Claim Services (PCS) Index events across the United States. A unit of the Insurance Services Office, Inc. (ISO), PCS provides insurance and reinsurance carriers with data about property losses due to a catastrophe.

2023 Storm-Related Claims

We had only one major hurricane landfall in Florida in 2023, Hurricane Idalia, which generated almost 500 claims for us. However, the state was not quite as lucky at avoiding PCS events; a total of 12 events impacted Florida policyholders. We received over 3,500 PSC claims, with our largest event resulting in 1,700+ claims for Tower Hill Insurance Exchange.

But wait, there is a silver lining to all of this. We ended 2023 just shy of our goal to have 100% of the claims closed for all named storms and PCS losses received. That’s an excellent ratio of closed versus open claims at year’s end. Now, let’s get to the gut-wrenching part: Money. For 2023 we paid out over $67 million in catastrophe-related claims. Over 90%, or $61 million, of this came from PCS claims.

Monitoring Weather 24/7 Year-Round

So, as you can see, managing catastrophes is not just a six-month stress test that happens only during each hurricane season. It’s an 8,760 hour, 365 day, 52 week, 12 month event that requires 24/7 monitoring of weather across Florida and the nation. November is generally the time of the year when catastrophes start to mellow out. Cooler air shifts down from the north, and sea surface temperatures start to decrease. We also experience more wind shear along the Gulf region, which limits storm development.

Of course, that doesn’t mean we all were off the hook, because hurricane season lasts through November 30th. But these seasonal changes do help limit the overall strength of tropical development. Also, it helps to push most of the storm action away from the U.S.

So, there you go. Hopefully, this helped you better understand how the season works. To keep up with current activity, be sure to check out our THIG.com blog, CAT365. Be safe out there, folks!

Exchange Member Testimonial

The Kropfs have been Exchange members since 2022; the couple retired from Upstate New York for the warmer weather.

Gerard & Christine Kropf of Venice, Florida

The Kropfs have been Exchange members since 2022; the couple retired from Upstate New York for the warmer weather. Unfortunately, along with Florida’s more tropical climate comes the greater risk of hurricanes.

On September 29, 2022, Gerard and Christine’s home sustained significant damage from Hurricane Ian. As you’ll recall, this storm was the second major hurricane of the 2022 Atlantic storm season and caused considerable devastation to Florida’s West Coast.

Thankfully the Kropfs were safe, but their retirement home was in Hurricane Ian’s path and needed repairs. Their pool cage was destroyed; soffits and fascia were damaged and torn away. Metal storm shutters were ripped off their house, and there was sufficient roof damage to allow water to come through the master bedroom ceiling.

Gerard was impressed by Tower Hill’s quick response after Ian. He explained, “I was surprised I got a text message probably about six hours after it [Hurricane Ian] ended saying if you’ve sustained damage and wish to initiate a claim, just click on this link.”

Before and after a storm or high wind event, Tower Hill sends outreach SMS messages to members in the storm’s path for whom we have a mobile number in our system. Gerard continued, “I sent a few pictures, and that’s how effortless the process was. I thought I was going to be getting busy signals for the next three days. The experience was outstanding!”

Tower Hill scheduled the claim adjuster within a couple of days, and the inspection was completed within four days. Gerard added, “I was hearing horror stories from other people three months into it that had not seen their adjuster yet…. The adjuster was very good about covering everything and even pointed out a few things that I had missed.”

“The adjuster was very good about covering everything and even pointed out a few things that I had missed.”

— Gerard Kropf, Exchange Member

As a reminder, you can add or change your mobile phone number by contacting your insurance agent or through your secure Customer Portal account at THIG.com/portal.

Agent Corner: Insight From Our Agents

We reached out to two of our partners and asked them to share their Tower Hill experiences. We are only as successful as the relationships we build.

Ryan McHugh, P&C Specialist

James J. McHugh Insurance & Financial Services, Inc.

West Palm Beach, Florida

When it comes to insuring your home, the last thing you want to do is simply find the cheapest option. You want to do a thorough review to be sure you understand what coverage options are available and which are a necessity for you. Discuss with your insurance agent your deductible options and if there are any specific exclusions on the policy, while also validating how much your home should be insured for. Many times, clients aren’t aware of what coverages they are carrying or what they mean.

Over the last few years we have seen insurance carriers go out of business, exit the Florida market, or implement exponential rate increases. Our goal, as the agent, is to place you with a carrier for the long term that is going to be there when you need them.

In the current market, both insurance and climate, we have seen dramatic changes, and you want a carrier that is solid with a proven track record. For me, the main things I focus on are carrier assets, renewal consistency, history, and claims record.

We deal with a multitude of insurance carriers, and I hold Tower Hill in the highest regard. I have seen claims from $300,000 to over $1 million paid timely, and the handling of them with the best customer service out there. The great thing with Tower Hill is that you get competitive pricing with top-notch coverage and service. If a claim should happen, we do not want you wondering if the carrier is going to pay you. Tower Hill is one of the best.

Trey Hutt, President

Hutt Insurance

Panama City, Florida

Your home is probably your largest asset, and almost certainly your most important. It’s where we lay our heads at night, gather with family, and it’s where we feel safe. Protecting it properly is a bigger decision than we often realize. In my experience, too few clients ask the right questions when shopping for insurance. Price, features, convenience and other things are considerations, but I suggest you ask the questions that I hear after a claim right up front, when you purchase. Things like, “Will my insurance company handle my claim fairly?” “Will their finances survive a huge hurricane?”

I ask these questions, and the answers often lead me to recommend Tower Hill. With over 50 years in Florida, they know claims, especially hurricanes. When Hurricane Michael brought Cat-5 destruction to our community, Tower Hill brought the money, the experience, and the talented claims people that helped us rebuild. After Hurricane Michael crushed Bay County in 2018, Tower Hill showed up in force and stayed as long as we needed them. Fifty years of experience with Florida hurricanes, strong finances, and great people made all the difference. They gave me the confidence to answer, “Yes, you’ll be ok.”

Process Improvements and Savings

In the digital age, Tower Hill has embraced technological advancements to enhance the customer experience and maximize operational efficiencies. Among these advancements is the option for customers to enroll in electronic documents (eDocs) and paperless delivery of policy documents via Tower Hill’s Customer Portal.

eDocs offer a number of advantages for our members:

- Immediate and easy access to policy documents.

This allows members to view, download, and print their insurance policies from any connected device.* - Enhanced security and privacy

Policy documents are stored in your password-secured Customer Portal account. - Sustainability

eDocs reduce the need for paper, printing, and physical delivery, significantly lowering the company’s carbon footprint. - Cost Savings

The cost to print and mail policy documents can amount to $8-$10 annually per policy. This might not sound like a lot, but for a company with 300,000+ policies, it adds up to millions of dollars a year.

Midway through 2022, however, we found that only nine percent of Tower Hill’s policies were enrolled in eDocs. Accordingly, Tower Hill initiated a Lean Six Sigma project to identify ways to increase eDocs enrollment. The effort led to a number of enhancements to streamline the eDocs enrollment process and improve the overall user experience, including:

The results were dramatic. Since the updates were implemented in May 2023, eDocs enrollment rates have increased more than four-fold, and Customer Portal registrations have increased by 25%. As a result, eDocs adoption is on track to reach 25% by May of this year, resulting in significant cost savings for Exchange.

That being said, we realize that some members simply prefer good old-fashioned paper documents, and that’s okay! We still encourage members to enroll in Customer Portal, which boasts a number of new enhancements as well, including enhanced claim status tracking, expanded account, payment, and claim status alerts and notifications via email and text messages, and an overall improved user experience. If you haven’t already, sign up today at THIG.com/portal.

* Please note that certain policy documents will continue to be delivered via postal mail as required by law.

Service Excellence:

Our Commitment to Member Care, Insights, and Innovation

2023 was an exceptional year at Tower Hill for many reasons. In addition to achieving growth milestones, we came together with a unified commitment toward achieving service excellence. Guided by our promise to provide excellent service with compassion and empathy, it is also our goal to provide the best experience in the industry.

While navigating the demands of a hard insurance market during a time of accelerating technology and evolving consumer expectations, one might think this would be a challenge. But to us, service excellence is not just a strategy; it is authentically who we are and what we do – deliver the highest quality experience with ease, consistency, and care.

Florida CFO Jimmy Patronis with the members of Tower Hill’s Catastrophe Response team; Fanning Springs, September 2023.

We Care About Our Members

Your peace of mind is our purpose. Whether it’s safeguarding your home, protecting your assets, or providing timely assistance during a claim, we stand by you. Our committed team takes care in ensuring your questions are answered, concerns are addressed, and claims are handled fairly and in a timely manner.

With members as our top priority, our representatives serviced half a million calls with over 92% answered in under 30 seconds. Plenty of adjusters were in place to manage thousands of claims; and we were never short of employee volunteers, ready to serve members during the aftermath of major storms. “Service by the Numbers” provides a glimpse into what our teams accomplished this year.

We Listened to Your Feedback

Your insights matter. We actively seek feedback from members because we believe that your experiences shape our services. Your suggestions drive positive changes, and we are committed to continuous improvement based on your valuable input.

In 2023, we added surveys at multiple touch points to capture your feedback. Whether you are a new member, speaking to a call center representative, or experiencing the claims process, we welcome your feedback. Since the launch of our New Member Survey, 88% expressed high satisfaction with their agency’s service and onboarding process, while our longer-term members noted professional and polite customer service, caring and timely service by adjusters, and a superior hurricane response compared to others.

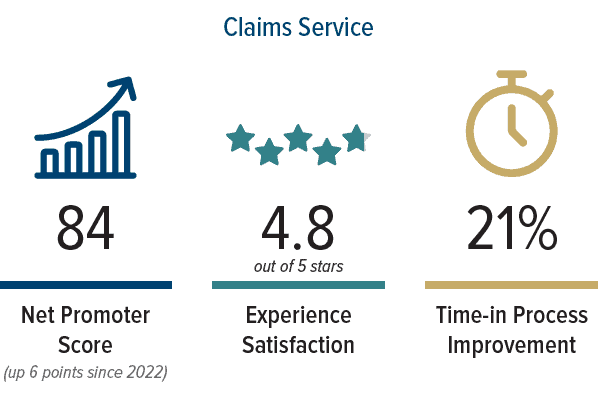

Claims’ customer satisfaction resulted in 4.8 out of 5 stars, with a Net Promoter Score of 84 for the year, excellent for our industry, and up six points from the prior year and 12 from two years ago. And we’re not done yet…

We Continue to Improve and Innovate

We are committed to investments in technology, streamlined processes, and innovative solutions to enhance efficiency and fuel growth. From agent interactions to faster claims processing, we are on a relentless quest for operational excellence to serve you better. In 2023, we improved internal processes and our online Customer Portal capabilities, resulting in 21% faster claims resolution and enhanced self-service options.

We also made a significant investment in a new cloud-based call center platform that allows us to expand our service capability, which we will expand this year to offer more seamless and efficient service.

In 2024, our members will speak to even more highly skilled contact center agents, experience faster and more innovative claims processing, and benefit from personalized experience through artificial intelligence (AI). All of this will be made possible through our committed teams and input from you. We are looking forward to the future and excited to keep you posted.

Preventing Water Damage

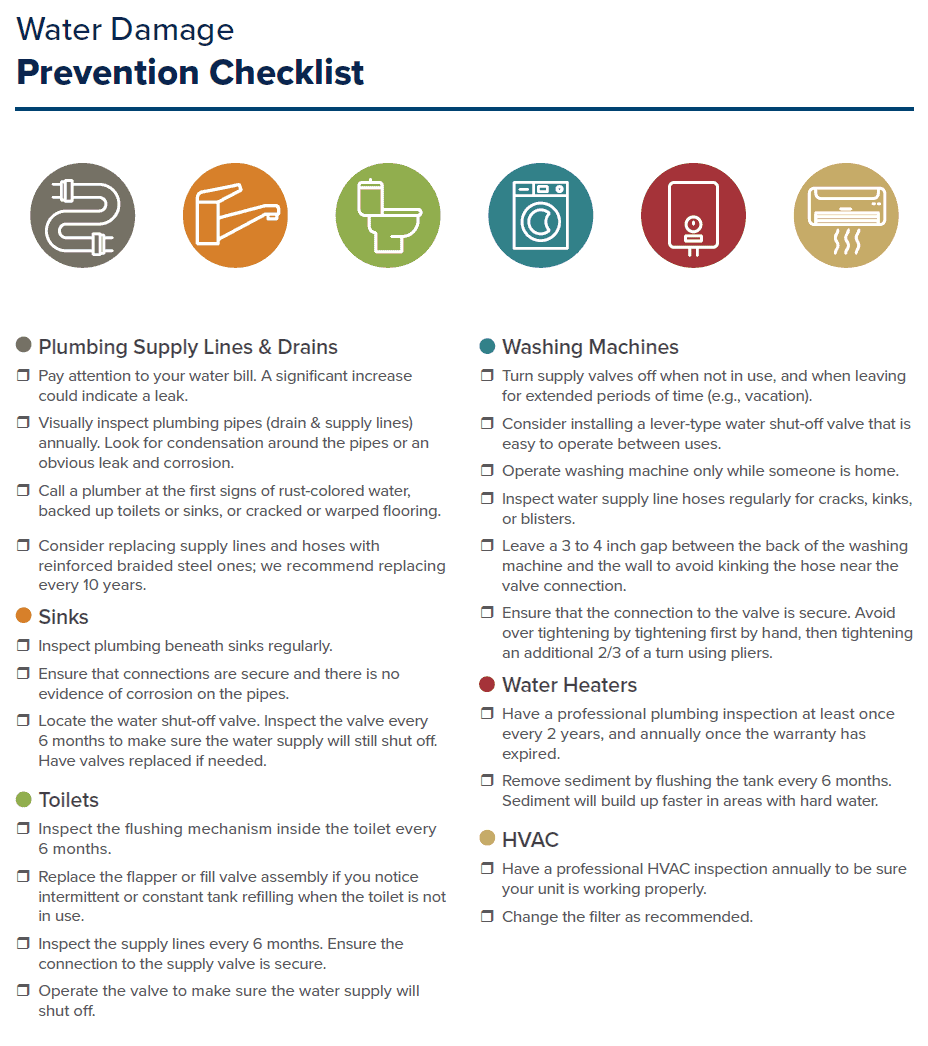

Water damage to your home often goes unnoticed until the problem becomes serious and costly. However, routine home maintenance can often help you prevent water damage before it happens.

Many water losses are either preventable or can be easily contained when caught early. According to the Insurance Information Institute (iii.org), nearly one-fourth of insurance claims in 2021 resulted from water damage and freezing, with an average repair price tag of more than $12,000. Although in Florida water pipes that freeze and burst only happen in the northernmost counties, water damage occurs year-round throughout the state.

Shut-Off Valve

Where is your home’s water shut-off valve? If you don’t already know, it’s important to find out! This one valve controls water into your home, so if there’s an emergency such as a burst pipe, you can stop the flow quickly with the main shut-off valve until the plumber arrives.

Smart Home Water Detection Systems

These days, smart water leak detection devices and automatic water shutoff valves are increasingly popular. Small sensors can be placed in multiple areas of your home, such as by water heaters, washing machines or exposed pipes. These sensor-based systems notify you via your smart phone or connected device if there’s a leak. Advanced systems assess the flow of water in your home and automatically shut off the main water supply.

Here’s a closer look at some potential trouble spots. Our prevention checklist on the next page provides tips for preventing water damage.

Sinks & Toilets

Water damage from sinks averages $7,000 per incident, whereas damage from toilets can average up to $10,000, depending on the cause and how long the damage goes unnoticed. Faulty plumbing supply lines are often the culprits of water damage, especially in older homes.

Appliances

On average, about 50% of the time a burst water supply line is responsible for water damage involving washing machines and can result in thousands of dollars in repair costs. Usually hidden behind the refrigerator, ice maker and filter water lines that become clogged or leak slowly over time can cause serious damage to nearby walls, flooring and cabinets. Similarly, dishwasher leaks unnoticed can also cause considerable damage to kitchen floors and cabinetry.

Water Heaters

The lifespan of a typical water heater is between 10 and 15 years, and it’s estimated that 75% of all water heaters fail before they’re 12 years old. Although it can be inconvenient when water heaters fail and leave you without hot water, leaks caused by corrosion, faulty valves or loose connections can cause significant damage.

Flushing out the water heater tank once a year helps remove any buildup of sediment, along with routine inspections to check for leaks or wear and tear, can help prevent unexpected water damage.

Air Conditioner Systems (HVAC)

If an HVAC system isn’t well maintained, water damage can result from an overflow caused by a clogged up drain or a piping connection. Especially in Florida where we depend on air conditioning nearly year-round, it is important to schedule routine maintenance for your HVAC system to be sure it’s cooling and draining properly.

Navigating the Impact of Insurance Fraud

Each year, billions of dollars are lost to insurance fraud. According to the Coalition of Insurance Fraud, insurance fraud across all lines costs Americans at least $308 billion a year. The Federal Bureau of Investigation (FBI) estimates that Florida homeowners pay an additional $1,000 of insurance premiums each year due to fraud.

At Tower Hill, we believe that we have a responsibility to our members, agents, employees, and all Floridians to fight property insurance fraud. And as such we have an in-house specialized team of investigators whose primary responsibility is to detect and investigate fraud.

Our Special Investigations Unit (SIU) is the tip of the spear in Tower Hill’s efforts to combat fraud. The SIU’s principal focus is detecting and investigating all suspicions of insurance fraud, with a special emphasis on educating our insurance professionals to help identify fraud. Insurance fraud can occur at any point throughout the entire lifecycle of an insurance policy. In some instances, fraud begins when a policy is purchased – at the point of sale – or during the underwriting or claims process.

In 2023, the SIU received nearly 2,600 internal fraud referrals. These internal referrals – received from both employees and insurance agencies – resulted in more than 1,100 investigations. Tower Hill submitted almost 500 referrals to the Florida Department of Financial Services (DFS), which has the authority to file criminal charges for insurance fraud. In 2023, these referrals resulted in the prosecution of several individuals, including members,

contractors, and other third-party entities.

We continue to invest in and leverage technology tools, which keep SIU on the cutting edge of fraud detection and investigation. Examples of these highly effective tools include: machine learning models, analytics software solutions, and open-source intelligence.

Tower Hill is committed to being an industry leader in combating fraud by collaborating with law enforcement and taking the necessary internal steps to reduce costs for our members. Rest assured, Tower Hill employees are united in our efforts to identify, report and help stop fraud. We work together to build on our success by fighting fraud with even greater awareness, vigilance, collaboration, and patience.

You can report suspected insurance fraud directly to Tower Hill Insurance Group by phone or email.

If you wish to report a fraud tip anonymously, call our Hotline at 866-265-6590. Or send us an email at towertips@thig.com.

Financial Metrics

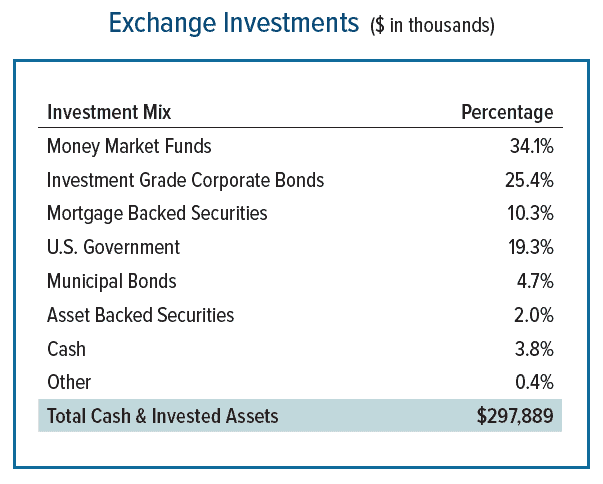

2023 was a positive year for Tower Hill Insurance Exchange’s (Exchange) investment program. A short duration profile has allowed Exchange to take advantage of high short-term interest rates while managing interest rate risk as US monetary policy focused on combating inflation.

Investment Summary

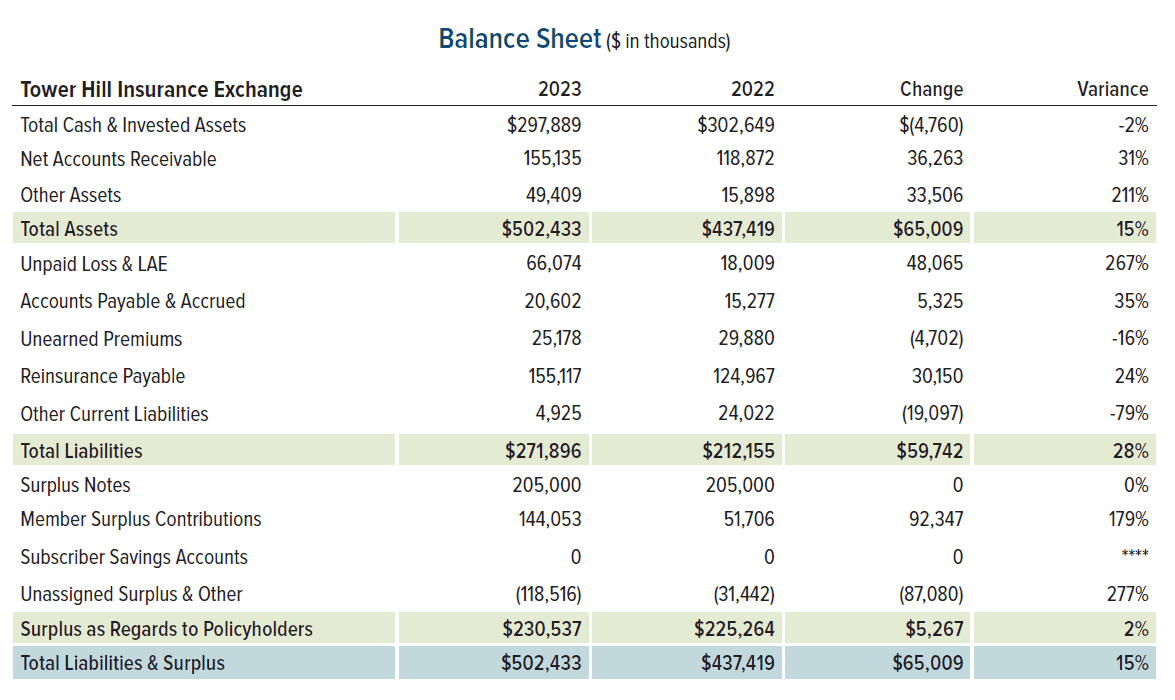

In 2023, Exchange conducted a deep-dive review of the invested assets using dynamic financial analysis and modeling to maximize the long-term economic value of the portfolio. Exchange’s cash and invested assets totaled $298 million at the end of the year. The assets of the company remained stable in 2023 and grew to over $500 million, driven by positive investment return and surplus contributions from members like you.

Tower Hill’s conservative investment strategy focuses on diversified, high-credit-quality, fixed income assets on the shorter end of the yield curve. The investment portfolio is managed by Conning Asset Management, a leading global investment firm specializing in the insurance industry.

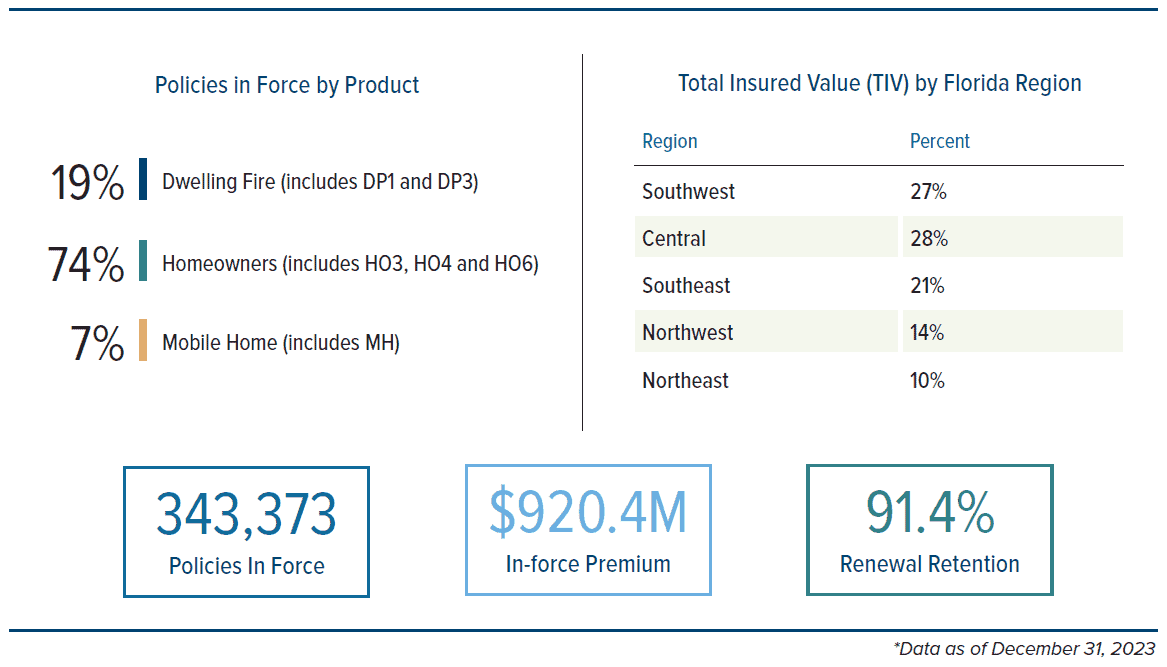

Here’s a snapshot view of Exchange member regions and products.*

Insurance Industry Ratings

Demotech, Inc. reaffirmed Tower Hill Insurance Exchange’s Financial Stability Rating® (FSR) of A, Exceptional based on the company’s positive surplus, the liquidity of the investment portfolio and the reasonableness of Exchange’s loss reserves, among other factors.

Kroll Bond Rating Agency (KBRA) reaffirmed Tower Hill Insurance Exchange’s Insurance Financial Strength Rating (IFSR) of BBB+, with a Stable Outlook based on Exchange’s sound risk-adjusted capital metrics, conservative investment portfolio, and strong catastrophe reinsurance program, among other factors.

Both ratings reflect Tower Hill’s longstanding strength in the Florida market, the level of catastrophic reinsurance protection, and the continued operational support and underwriting expertise of Tower Hill’s partners Gallatin Point Capital, Vantage Group Holdings, Ltd. and Renaissance Re.

Direct Written Premium

Policies from affiliate Tower Hill carriers: Tower Hill Prime, Tower Hill Signature and Tower Hill Preferred, completed the transition to Tower Hill Insurance Exchange in 2023. Direct Written Premiums increased by $415 million or 82.7%

from 2022 and reached $917 million, and are expected to increase an additional 20.6% in 2024. Exchange continues to provide increased underwriting capacity and flexibility to agents and customers in the Florida market.

Combined Ratio

The Combined Ratio of an insurance company is a measure of expenses and losses compared to premiums. The Combined Ratio net of Reinsurance recoveries is used by the company’s management to evaluate underwriting results and the effectiveness of the Risk Management program. The Combined Ratio, net of Reinsurance, for Exchange was 135.8% and 95.7%, for 2023 and 2022, respectively.

The 2023 results were driven primarily by increased catastrophe reinsurance costs. Catastrophe reinsurance costs increased by an estimated 50% industry-wide in 2023. Florida also experienced several severe convective storm events as well as Hurricane Idalia, which elevated losses. Despite some headwinds in 2023, the company’s management expects favorable softening in the reinsurance market and a focus on growth to drive profitability in 2024.

Subscriber Surplus Contributions

Surplus contributions are included with your policy premium and are a part of your membership in Exchange. Surplus contributions made by members were $92 million and $52 million for 2023 and 2022, respectively.

Your surplus contribution lowers Exchange’s cost of capital and allows the company to offer more competitively priced insurance to all members. Through these surplus contributions, you are participating in the company’s success and building an ownership stake.

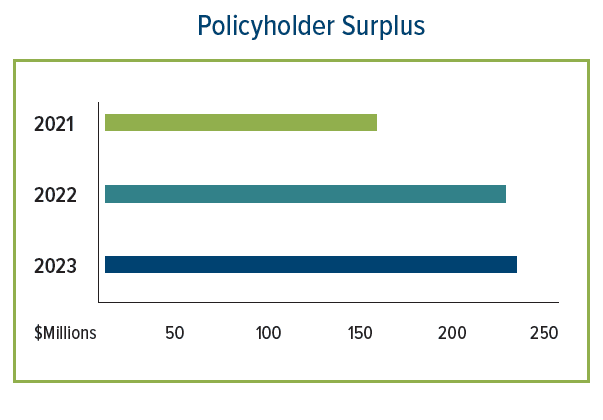

Policyholder Surplus

Policyholder Surplus is a financial cushion that protects an insurance company’s policyholders in the event of unexpected or catastrophic losses. This number is an indicator of financial health and represents the capital available when an insurance company’s liabilities are subtracted from its assets.

In 2023, Exchange’s surplus grew by 2.3% and totaled $231 million, driven primarily by surplus contributions from members. The additional capital strengthens Exchange’s balance sheet, enables continued growth and builds the financial cushion that protects all Tower Hill Insurance Exchange members.

© 2024 Tower Hill Insurance Group, LLC | PO Box 147018, Gainesville, FL 32614 | 800-342-3407 | THIG.com